Let’s explore the power of data. Transforming raw data into real value begins with the concept of relevance. Merriam-Webster defines “relevance” as having ‘relation to the matter at hand’, ‘practical … applicability’, or ‘the ability to retrieve material that satisfies the needs of the user.’ In a world that is increasingly flooded with data, relevance is in high demand. The last thing management in any industry needs for more irrelevant data. The burning need always has been, and continues to be, actionable information that is concisely-presented and relevant to the ‘matter at hand.’

Consider US healthcare. While congress deliberates on revisions to Obamacare, the cost of specialty medications, secondary care and tertiary care continues to rise. The percentage of the US economy accounted for by healthcare now approaches 20%. The matter at hand is to eliminate waste and find the best care at the lowest price and place it within reach of those who need it most urgently. The answers to these issues are relevant.

In an effort to help those bearing the financial risk (e.g. self-insured employer plans) to gain control over these costs, analytics companies obtain and process mountains of data – medical claims, pharmacy claims, biometric information, blood screen results, vision tests, questionnaires, and even consumer data. Then, running this data through algorithms, regression analyses, and predictive models, these same companies return computational results to their users in an often bewildering array of tables, charts, graphs, diagrams and narrations. Regrettably, not all of the information is relevant.

Pareto’s Law (also known as the ‘80/20 Rule’) applies in dramatic fashion in healthcare. In general, a small percentage of any population accounts for a disproportionately large share of the plan’s expenses. Most wellness programs focus efforts upon the masses (i.e. the 80%). However, in actuality, most of a plan’s expenses originate with a small number of plan participants (i.e. the 20%). In fact, as few as 3-5% of plan participants often account for one-half of a health plan’s expenses, somewhat regardless of the plan, the geography, or the demographics of the population. Imagine the impact on health and on cost that could be realized if the 3-5% could prevent their condition from deteriorating. Diabetes, cardiac conditions, and even some cancers can be readily identified in early states by the pro-active use of predictive analytics. Such a list of future high-cost claimants, the 3-5%, would be relevant information.

Beyond relevance rests ‘simplicity’ – solutions that go a step further and automatically act upon relevant information. The financial investments industry mastered this idea years ago by creating mutual funds. Mutual funds are investment pools managed by skilled asset managers. Previously, analysts had to convert macro-economic statistics into a list of promising stocks that stock brokers could give to clients to provide relevant investment advice. Then, someone realized that the investment process could be simplified by forming a diversified portfolio into which investors could directly invest. Mutual funds represent a hands-free way to combine both relevance and simplicity into an investment vehicle that eliminates the need for individuals to study, and take action on, investment reports. Mutual fund investors don’t read reports or pick stocks. They leave that with their portfolio managers.

Healthcare is responding with similar, coordinated solutions. Programs are emerging which integrate all digitally-available medical information and translate the data into actionable and relevant information. Then, like a portfolio manager who synthesizes disparate economic reports into an investment strategy, clinical care coordinators integrate disparate data sets and provide guidance to plan participants who can take action to increase the likelihood that they receive the best care, at the best facilities, at the lowest price.

The final responsibility for human health rests with the individual (or parent or guardian) but the technology to give relevant, simple guidance exists. Consumers need to demand and take advantage of price transparency, just like they do when shopping for other goods and services.

Today, the race is on to transform raw data into useful information that will result in weeding out ineffective providers, sub-par facilities, and overpriced medications. Transparency is improving and analytics are revealing opportunities to save. To conclude, consider how this true story sheds light on the value of relevant information.

Several months ago, while visiting the US Northwest on a business trip, I stopped at an independent drugstore to pick up two prescription medications. The drugstore did not participate in my health plan, and the cashier stated that the price for the two (common) medications would be $450. I was stunned. While traveling in South America the prior year, I had paid $52 for the same supply of the same two medications. I’ve since ordered the same quantity of these drugs for $163. Imagine how an investor would feel after paying $450 per share of the same common stock that could be ordered online for $163 a share. The inefficiencies in US healthcare are still excessive and are responsible in part for the size of this sector of the US economy. But the better analytics companies are transforming raw data into relevant information. Astute self-insured plan managers must partner only with analytics companies that offer relevant information in simplified solutions.

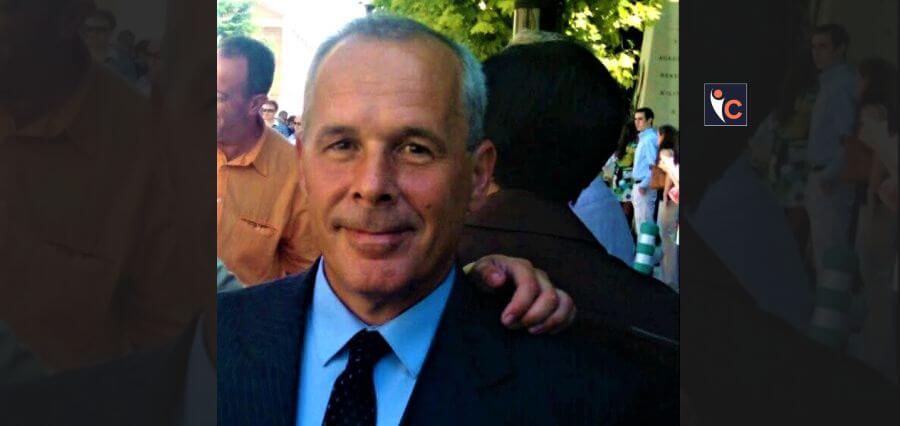

About The Author

Jonathan M. Prince, CEO of DataSmart Solutions, brings 35 years of business administration experience to the U.S. healthcare industry. As CEO for DataSmart Solutions, he is responsible for seeing that DSS fulfills its mission to help raise the quality and significantly lower the cost of U.S. healthcare through predictive analytics. Taking a population-based, big-data approach, DSS evaluates and identifies members who are at the greatest risk of health deterioration (and toward whom early intervention resources should be directed); DSS also assists in optimizing benefit program design and in provider evaluation and benchmarking. Prior to joining DSS, Jon worked 30+ years in financial markets with experience in sales, trading, management, business redesign, and client relations.